The Claremont School District is confronting a severe financial crisis, initially revealing a $5.1 million deficit that has since been reduced but still threatens its future operations. The district has already implemented drastic measures, including staff reductions and the closure of an elementary school, and now faces the possibility of being unable to open for the 2026 school year without significant intervention.

This situation has brought renewed attention to New Hampshire's controversial education funding model, which relies heavily on local property taxes and provides significantly less state support than the national average. The crisis in Claremont highlights systemic issues that experts believe could affect numerous other communities across the state.

Key Takeaways

- The Claremont School District is managing an unanticipated deficit, which was initially reported at $5.1 million.

- Cost-saving measures have included closing a school, cutting staff, and eliminating extracurricular activities.

- The district may lack the necessary cash flow to open schools in the fall of 2026 without external financial aid.

- The crisis has sparked a debate over New Hampshire's education funding system, which contributes only 20% to public education costs, compared to the national average of 47%.

The Anatomy of a Financial Collapse

The financial problems in the Claremont School District did not emerge overnight. According to reports, the crisis is the result of administrative issues spanning several years. Local officials and state auditors have pointed to a lack of proper financial oversight and reporting as primary contributors to the deficit.

The Claremont School Board has faced criticism for not addressing warning signs sooner. Observers noted that financial reports were consistently filed late, and essential data required for federal grants was not provided. These administrative failures continued until auditors uncovered significant irregularities in the district's accounting practices.

As a result of the deficit, the district has been forced to make deep and painful cuts. These include:

- Reducing the number of staff members across the district.

- Closing an entire elementary school to consolidate resources.

- Unfunding sports teams and other extracurricular programs.

- Operating without a budget for substitute teachers.

Despite these measures, the district still projects a shortfall of nearly $2 million by the end of the current school year, putting its long-term viability in jeopardy.

A Systemic Problem Beyond One District

While Claremont's situation is acute, it is not an isolated incident. The financial instability reflects a broader challenge rooted in New Hampshire's method for funding public education. The state's system places a heavy burden on local property taxes to cover the majority of school expenses.

New Hampshire's Education Funding Model

New Hampshire's state government contributes approximately 20% of the total cost of public education. This is less than half the national average, where state governments contribute around 47%. The remaining 80% in New Hampshire must be raised primarily through local property taxes, creating significant disparities between property-rich and property-poor communities.

This model creates a difficult environment for towns and cities with a limited tax base. Many of these communities, including Claremont, Newport, Franklin, and Berlin, were once industrial hubs. After major employers like Joy Manufacturing, which closed its Claremont factory in 1983, left the state, their tax bases eroded. However, their affordable housing continues to attract young families, leading to stable or growing student populations that the local economy can no longer support.

This disparity has led to legal challenges in the past. Claremont was one of the lead plaintiffs in a landmark lawsuit against the state over the equity of its funding formula. The current crisis suggests that the underlying issues identified decades ago remain unresolved.

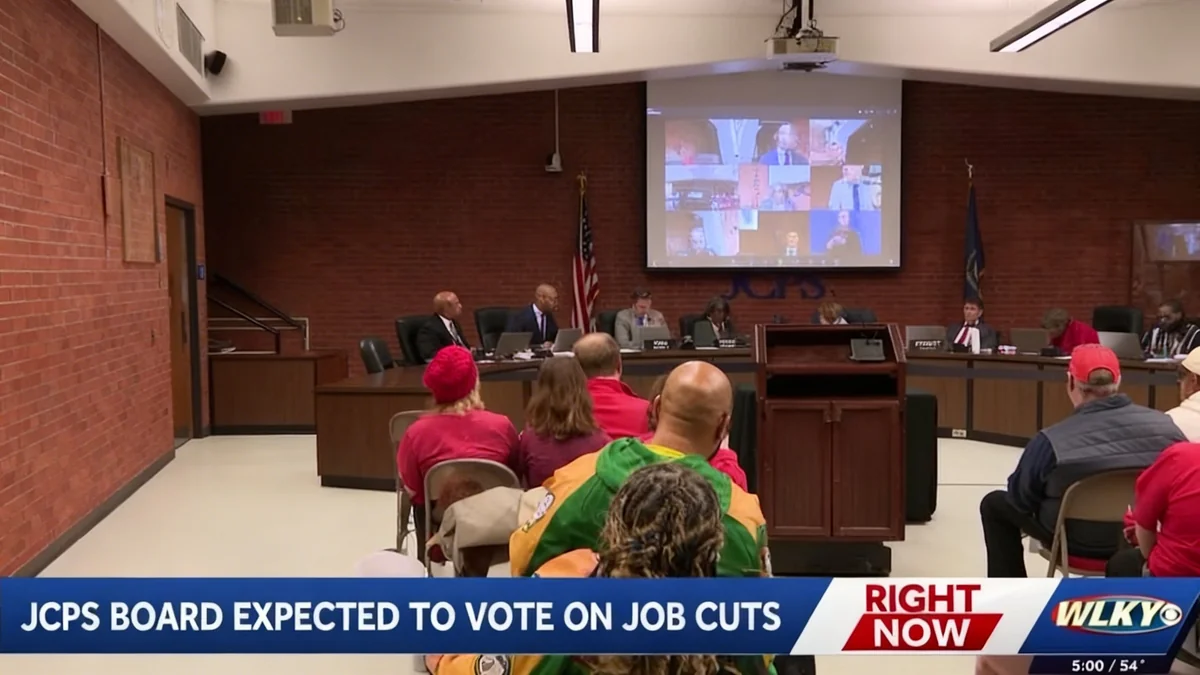

Political Division and State-Level Response

A recent public hearing on a proposal to provide financial assistance to Claremont revealed a divided political landscape. Some lawmakers expressed reluctance to approve a bailout, seeking accountability from local officials for the administrative failures that led to the crisis.

The debate extends to the role of the New Hampshire Department of Education. Critics argue that under former Commissioner Frank Edelblut, the department's focus shifted away from supporting traditional public schools. They point to the promotion of the Education Freedom Account (EFA) program, a voucher-style system, as evidence of a policy direction that diverts public funds.

Education Freedom Account Program Scrutiny

A compliance test conducted by the Department of Education found a 25% error rate in determining eligibility for the EFA program during its first two years. This finding has raised concerns about the oversight and management of the program, which provides state funds for families to use on private education and homeschooling expenses.

Proposals are now circulating for the state to have the authority to place financially troubled school districts into receivership. However, questions remain about whether the Department of Education has the staff and expertise to effectively manage a district's complex finances. Without adequate resources at the state level, such a policy may be ineffective.

The Future of Education in the Granite State

The situation in Claremont serves as a critical warning for other school districts in New Hampshire. The reliance on local property wealth creates an inherently unequal system where a student's educational opportunities can be determined by their zip code. Communities in the southern part of the state, benefiting from proximity to Massachusetts' robust economy, can often fund their schools at a much higher level than those in the North Country or along the state's western border.

"Until the education funding system changes in New Hampshire, there will be more and more school districts like Claremont with poor administrators, fiduciary failure, and students educationally short-changed."

Many argue that the concept of the "New Hampshire Advantage," often associated with low statewide taxes, fails to account for the high property tax burden placed on residents and the resulting inequities in public services like education. For communities like Claremont, this so-called advantage feels like a structural disadvantage.

Without fundamental reform to how New Hampshire funds its public schools, experts predict that more districts will find themselves on the brink of financial failure, unable to provide the quality education their students deserve.